Sprintax Calculus – NRA Tax Compliance System

International persons receiving income from GW (i.e. employment wages or salary, stipend, scholarship, fellowship, or award) should arrange with the Tax Department to complete the appropriate tax forms.

Effective, January 2025, GWU has replaced Foreign National Information System (FNIS) with secure, cloud-based system for nonresident alien tax compliance. Please note that Sprintax Calculus is a separate platform from Sprintax Returns, which is available for annual income tax preparation and tax filing to those who had relationship with GWU in an NRA capacity during the current tax year filing period. Sprintax Returns information can be found here.

- If you are a non U.S. citizen or non U.S. permanent resident and will receive payments from the University and have already not received an invite email from GWTax_noreply

sprintax [dot] com (GWTax_noreply[at]sprintax[dot]com), Request Sprintax Calculus access by sending an email to tax

sprintax [dot] com (GWTax_noreply[at]sprintax[dot]com), Request Sprintax Calculus access by sending an email to tax gwu [dot] edu (tax[at]gwu[dot]edu) with "Sprintax Calculus access" in the subject line. Include in the email the nature of your relationship with GW (employment, stipend recipient, etc.).

gwu [dot] edu (tax[at]gwu[dot]edu) with "Sprintax Calculus access" in the subject line. Include in the email the nature of your relationship with GW (employment, stipend recipient, etc.). - Once you receive the access email, you can login via single sign on with the following link https://calculus.sprintax.com/.

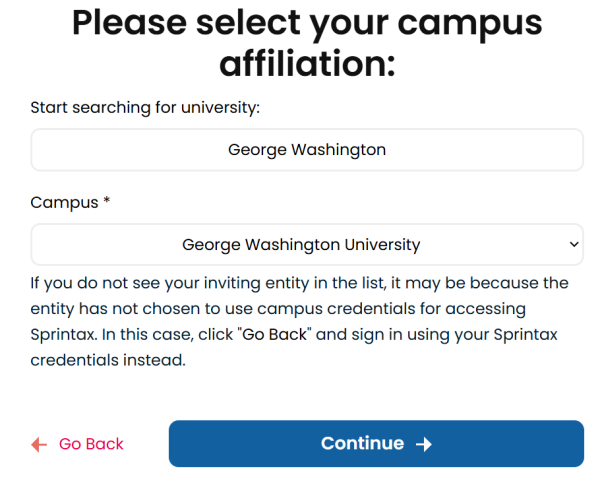

- Please refer to the User Guide and Common Questions to set up your Sprintax Calculus profile for the first time. Click "Campus", select George Washington University from the list and press Continue as shown below.

- You will be re-directed to GWU Authentication page. If using Sprintax Calculus for the first time, you will need to create a new account. You will be directed to the Sprintax Calculus platform.

- Sprintax Calculus requires multi-factor authentication (“MFA”) to provide you with the ability to e-sign tax documents. Once MFA is activated, you will be prompted for an MFA authentication code to access your Sprintax Calculus account. Please refer to the Sprintax 2FA Guide and the Sprintax 2FA Video for additional information.

- Sprintax Calculus user manual provides all the instructions to complete your profile. Please refer to Frequently Asked Questions about Sprintax Calculus for more tips on how to update your tax profile in Calculus.

- You can contact Sprintax Calculus directly for support. They offer a Live Chat feature, FAQs, and email support via calculussupport

sprintax [dot] com (calculussupport[at]sprintax[dot]com).

sprintax [dot] com (calculussupport[at]sprintax[dot]com).

For any further inquiries, contact us via email tax gwu [dot] edu (tax[at]gwu[dot]edu) or call tax line at 571-553-8313.

gwu [dot] edu (tax[at]gwu[dot]edu) or call tax line at 571-553-8313.